Ever wondered what your Compound Annual Growth Rate (CAGR) on investments is?

Or how much your expenses have increased on average over the past five years?

Curious about the annual compounded growth in company revenues?

Or the average annual growth in your subscriber base over the last few years?

These questions might sound familiar, especially if you’ve ever talked to investment advisors, bankers, or finance experts. They often throw around terms like absolute growth, average growth, compounded annual growth rate (CAGR) etc. during corporate presentations or when promoting investment products. Sometimes, these terms are used in ways that can confuse or mislead, making it tough to understand what they really mean and how they differ.

Let’s demystify these growth rates and make them easier to grasp.

You can download the companion excel file here and follow along.

Absolute Growth Rate

Return on investment is often stated in percentage terms. Let us assume you made an investment of ₹ 10,000 in a mutual fund which became ₹ 18,000 after 5 years.

Since the initial investment was ₹ 10,000 and the maturity value at the end of 5 years is ₹ 18,000, one may be tempted to say that the return on investment is 80%. Is this correct?

The answer is yes and no. While in simple layman terms the absolute return on an investment of ₹ 10,000 over a period of 5 years has actually been 80%, but the return on investments is often viewed on an annualized basis.

Average Annual Growth Rate (AAGR)

Let us assume your investment of ₹ 10,000 in a mutual fund grows over a period of 5 years as follows:-

|

Year |

Value of Investment |

|

0 |

10,000 |

|

1 |

12,500 |

|

2 |

13,500 |

|

3 |

15,000 |

|

4 |

16,000 |

| 5 |

18,000 |

So now, what is your annualized growth on investment?

Simple, 80% growth divided by 5 years = 16%. Correct?

Mmm……Again the answer is yes and no.

While, 16% may be simple average but it cannot be confused with Average Annual Growth Rate.

Average Annual Growth Rate (AAGR) is the arithmetic mean of a series of growth rates.

In our above example, first we will compute the yearly growth rates using the formula:

Yearly Growth rate = (Ending Value – Beginning Value) / Beginning Value

And then we will compute mean (average) of all yearly growth rates.

|

Year |

Value of Investment |

Annual Growth % |

|

0 |

10,000 |

|

|

1 |

12,500 |

(12500 – 10000)/10000 = 25% |

|

2 |

13,500 |

(13500 – 12500)/12500 = 8% |

|

3 |

15,000 |

(15000 – 13500)/13500 = 11% |

|

4 |

16,000 |

(16000 – 15000)/15000 = 7% |

|

5 |

18,000 |

(18000 – 16000)/16000 = 13% |

|

Average Annual Growth Rate = |

(25% + 8% + 11% + 7% + 13%)/5 = 12.7% |

|

AAGR is useful for determining trends or growth rates and it can be applied to almost any financial measure, including revenue, profit, expenses, cash flow, subscriber or customer base etc. to give investors an idea of which direction a company is headed for that particular measure.

However, used out of context, AAGR can be very misleading.

To illustrate, let’s add a sixth year to our example above in which markets crash and the value of investment comes back at ₹ 10,000.

|

Year |

Value of Investment |

Annual Growth % |

|

0 |

10,000 |

|

|

1 |

12,500 |

(12500 – 10000)/10000 = 25% |

|

2 |

13,500 |

(13500 – 12500)/12500 = 8% |

|

3 |

15,000 |

(15000 – 13500)/13500 = 11% |

|

4 |

16,000 |

(16000 – 15000)/15000 = 7% |

|

5 |

18,000 |

(18000 – 16000)/16000 = 13% |

|

6 |

10,000 |

(10000 – 18000)/18000 = -44% |

|

Average Annual Growth Rate = |

(25% + 8% + 11% + 7% + 13% – 44%)/6 = 3.1% |

|

Crazy? We can clearly see that our actual growth rate over six years is 0%. We started with ₹ 10,000 and ended with ₹ 10,000. So how can our average annual growth rate be 3.1%.

Because of this anomaly, AAGR is not regarded as the correct way to measure growth, and thus it is not a common formula for analysis. Most analysts use the compounded annual growth rate (CAGR) when evaluating changing financials.

Compound Annual Growth Rate (CAGR)

The compound annual growth rate (CAGR) is a useful & better measure of growth over multiple time periods. It can be thought of as the growth rate that gets you from the initial investment value to the ending investment value if you assume that the investment has been compounding over the time period.

The formula for CAGR is:

CAGR = ( Ending Value / Beginning Value) 1/n – 1

where n = Number of periods (months, years, etc.)

Continuing our earlier example, we can calculate CAGR for first 5 years of our investment as:-

CAGR = (18,000 / 10,000) 1/5 – 1 = 0.1247 or 12.5%

You may say, what a big deal? Our AAGR was also coming out 12.7% and CAGR is 12.5%. Hardly any difference….

Let us compute CAGR over six-year period when market crashed….

CAGR = (10,000 / 10,000) 1/6 – 1 = 0 or 0%

This reflects accurately what has happened. We began with ₹ 10,000 and ended with ₹ 10,000, which is a return of 0%.

Therefore, CAGR may be more complicated to calculate but at the end of the day, is a more accurate measure of compounded average returns, especially when returns are more volatile.

In real life situations, the real return on investment is the CAGR, and not the Absolute or Average Annual Growth Return as many investment brokers and fund managers may claim.

The impact of negative returns and the distribution of returns have significant negative effects on the realized returns investors experience. The more volatility experienced by the market, the larger the drop in the compound return.

To understand this a little deeper, let us assume, that your mutual fund operated in a very volatile market and the results are as follows:-

|

Year |

Value of Investment |

Annual Growth % |

|

0 |

10,000 |

|

|

1 |

15,000 |

50% |

|

2 |

12,000 |

-20% |

|

3 |

17,000 |

42% |

|

4 |

15,000 |

-12% |

|

5 |

21,000 |

40% |

|

Average Annual Growth Rate = |

20% |

|

CAGR = (21,000 / 10,000) 1/5 – 1 = 16%

How to Calculate CAGR in Excel

You may calculate CAGR in Excel by using the above basic formula in a cell.

After entering the formula, if you see the result in a decimal, you may change the cell format to percentage.

You can also use Excel’s built in function RRI or RATE function as follows:

= RRI (nper, pv, fv)

Where nper = Number of periods (months, years, etc.)

pv = Amount of initial investment

fv = Amount of investment at maturity

i.e. RRI(5, 10000, 21000)

or

= RATE (nper, pmt, pv, fv)

Where nper = Number of periods (months, years, etc.)

pmt = Additional payments

(Since there are no additional investments in our example, simply enter 0)

pv = Amount of initial investment (Enter this amount with minus sign)

fv = Amount of investment at maturity

i.e. RATE(5,0, -10000, 21000)

Download the companion excel file here and see the formulae in action.

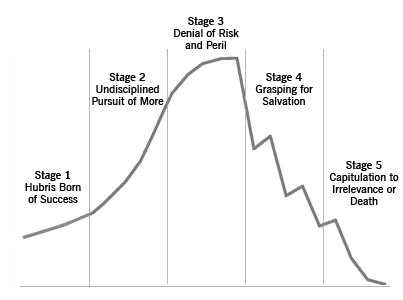

However, CAGR is also not free from its pitfalls. While CAGR is superior to average returns because it considers the assumption that an investment is compounded over time, yet CAGR is only a smoothed return over the time/period measured, only taking into account an initial and a final value when, in reality, an investment usually experiences short-term ups and downs. CAGR per se does not reflect volatility. In order to address this volatility (or investment risk), analysts often use statistical measure of Standard deviation which takes into account how annual returns might vary from the expected return.

Risk Adjusted CAGR

Very volatile investments have large standard deviations because their annual returns can vary significantly from their average annual return. Less volatile stocks have smaller standard deviations because their annual returns are closer to their average annual return. For example, the standard deviation of a savings account is zero because the annual rate is the expected rate of return (assuming you don’t deposit or withdraw any money). In contrast, a stock price can vary significantly from its average return, thus causing a higher standard deviation. The standard deviation of a stock is generally greater than the savings account or a bond held to maturity.

In order to compare the performance and risk characteristics between investment alternatives, investors can use a risk-adjusted CAGR. A simple method for calculating a risk-adjusted CAGR is to multiply the CAGR by one minus the standard deviation. If the standard deviation (risk) is zero, the risk-adjusted CAGR is unaffected. The larger the standard deviation, the lower the risk-adjusted CAGR.

The Bottom Line

CAGR is a good tool to evaluate investment options, compute financial growth in revenues or cash flows etc. because it takes into account the power of ‘compounding’. While it may not tell the whole story, but it is a superior measure and can be used as a first step to evaluate the real growth or return on investments.

You may download the companion excel file here and practice the growth rates discussed above.